Description

In this course, you will :

- Define the basis and the various sources of basic risk, as well as how basis risks arise when using futures to hedge.

- Define cross hedging, as well as the hedge ratio with the lowest variance and hedge effectiveness.

- Define and interpret the optimal number of futures contracts required to hedge a risk, including a "tailing the hedge" adjustment.

- Show how to use stock market index futures contracts to change the beta of a stock portfolio.

- Learn about the covered call and protective put strategies.

- Understand the benefits and drawbacks of various option spread strategies.

- Describe a typical commercial bank's ALM function.

- Recognize the balance-sheet risks associated with funding and duration gaps.

- Define, compare, and contrast economic, risk, and regulatory capital.

Syllabus :

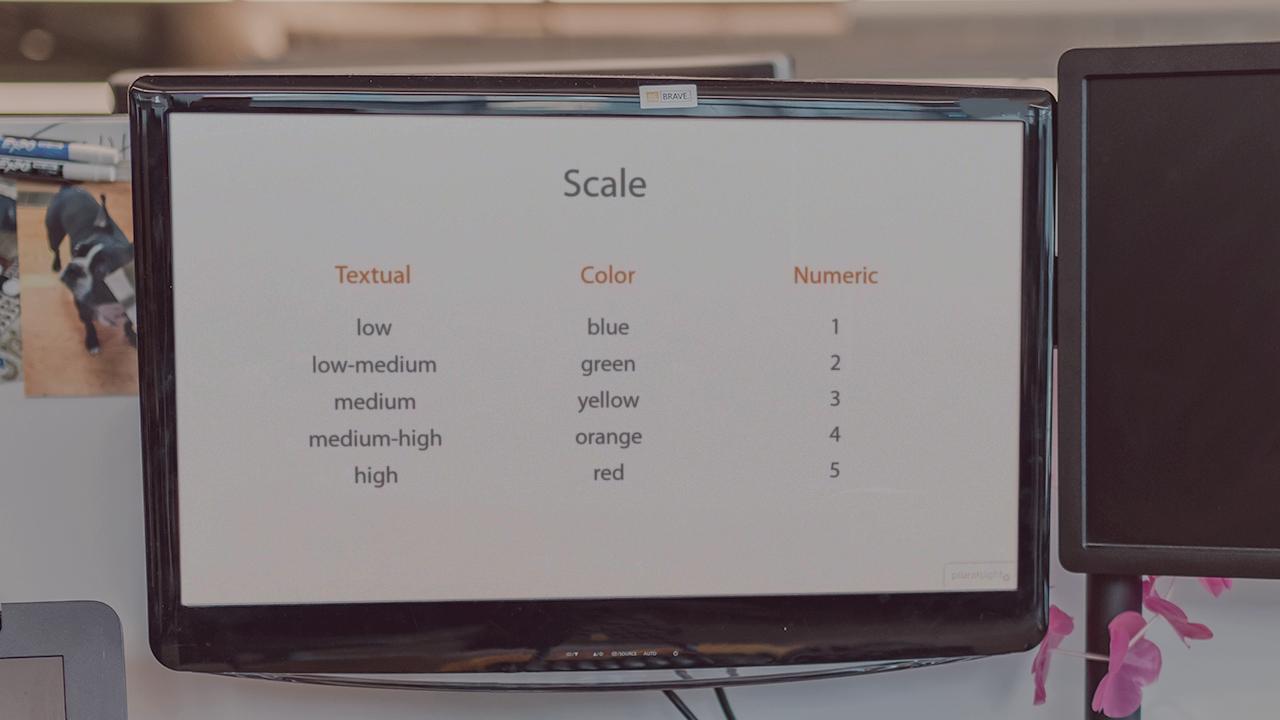

1. Risk Reporting

- Profit Distribution

- Risk by Risk Factor

- Risk Over Time

2. Model Risk

- Sources of Model Risk

- VaR Back Testing

- VaR Exceptions

- VaR Exposure Monitoring

3. Risk Management Tools

- Equity Swaps

- Hedging with Index Futures

4. Liquidity and Operational Risk Management

- Liquidity

- Liquidity Risk

- Operational Risk Management

5. Asset and Liability Management

- Interest Rate Risk

- Duration Gap Risk

- Balance Sheet Immunization

- Duration Gap vs Funding Gap

- Banking Book vs Trading Book

- ALM Governance